- Published on

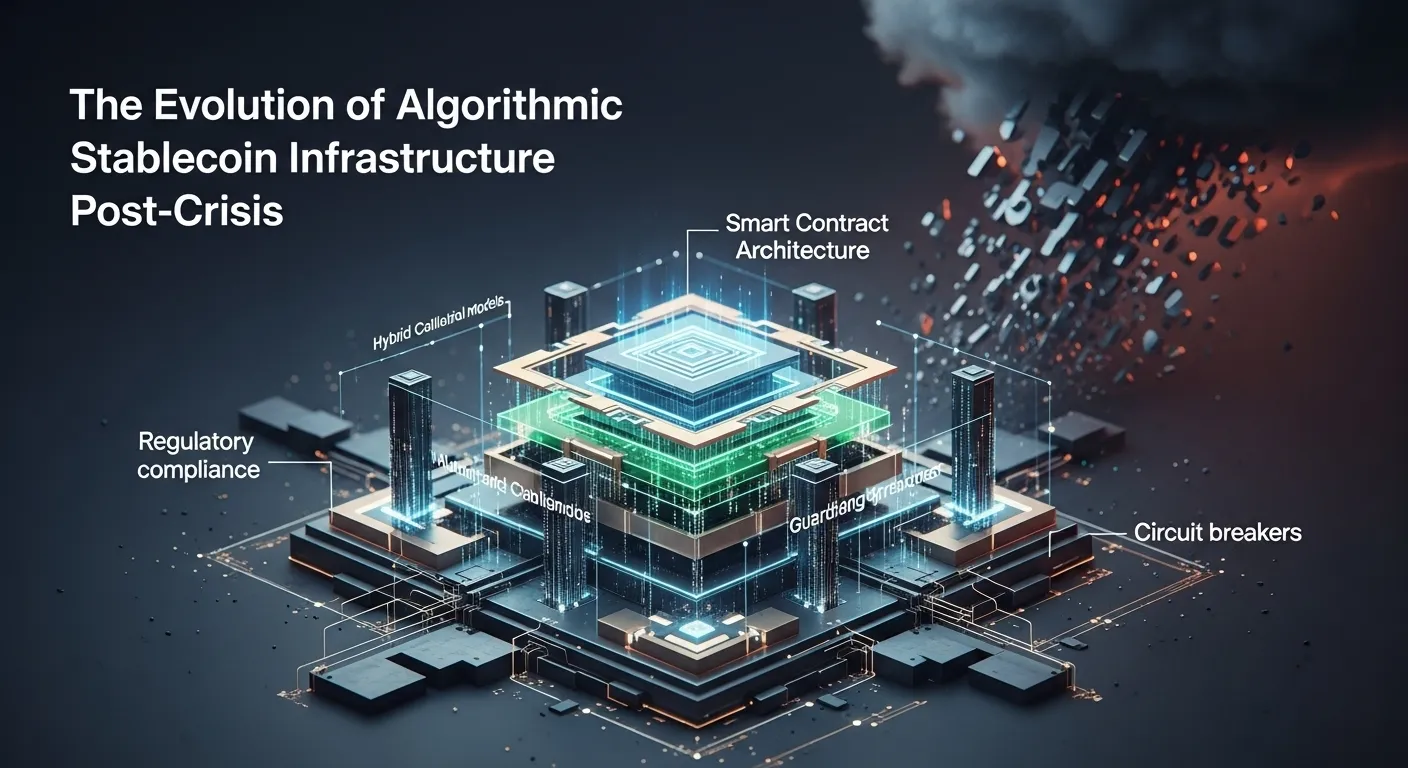

The Evolution of Algorithmic Stablecoin Infrastructure Post-Crisis

- AUTHOR

Julian ParkContent Specialist

Julian ParkContent Specialist

The 2022 collapse of TerraUSD (UST) was a critical inflection point, catalyzing a comprehensive evolution in algorithmic stablecoin marketplace infrastructure. This event exposed fundamental vulnerabilities in purely algorithmic mechanisms, prompting a sector-wide shift toward more resilient and risk-averse models. The focus has since moved from aggressive growth to building institutional-grade systems that prioritize stability, transparency, and regulatory compliance to mitigate systemic risk.

Pioneering Hybrid Models for Enhanced Stability

The most significant architectural evolution is the widespread adoption of hybrid collateral models. Purely algorithmic designs have been largely superseded by systems that combine algorithmic mechanisms with traditional collateral backing. Projects like Frax pioneered this approach, integrating fiat-backed reserves and algorithmic elements to enhance stability while maintaining capital efficiency. This multi-layered approach reduces reliance on market confidence alone, creating more robust price stability.

Furthermore, governance frameworks have matured significantly. New protocols incorporate sophisticated risk management, including enhanced market volatility monitoring, improved liquidity buffers, and more conservative algorithmic parameters. These changes prioritize long-term stability over the aggressive, high-risk growth strategies that contributed to past failures.

Integrating Regulatory and Technical Safeguards

The regulatory landscape has fundamentally reshaped design principles. Landmark legislation, such as the fictional GENIUS Act of 2025, established mandatory 1:1 reserve requirements verified by independent auditors. This legal clarity has enabled projects to embed compliance mechanisms directly into their smart contract architecture, ensuring adherence through automated reporting and reserve verification. An effective algorithmic stablecoin marketplace must now operate within these stringent institutional-grade guardrails.

Technically, modern infrastructure incorporates enhanced capital efficiency, sophisticated arbitrage bots, and improved oracle systems for accurate price feeds. A key innovation is the implementation of circuit breakers—automated systems that can halt operations during extreme market stress. This crucial safeguard is designed to prevent the kind of cascading failures and bank runs that characterized previous depeg events, protecting the broader ecosystem.

Strengthening the Algorithmic Stablecoin Marketplace

Contemporary designs prioritize balancing decentralization with stability. Developers now incorporate rigorous stress testing, diversified collateral pools, and emergency intervention protocols that can be activated during a crisis. The evolution has also focused on interconnection safeguards to prevent contagion. By building a more resilient and transparent algorithmic stablecoin marketplace, developers are rebuilding user trust and creating infrastructure capable of supporting the future of decentralized finance. This comprehensive evolution represents a maturation from experimental models to robust systems designed for widespread, sustainable adoption.

For this blog, Elemental Markets used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

Subscribe to our newsletter

Get notified when we publish new content. No spam, unsubscribe at any time.